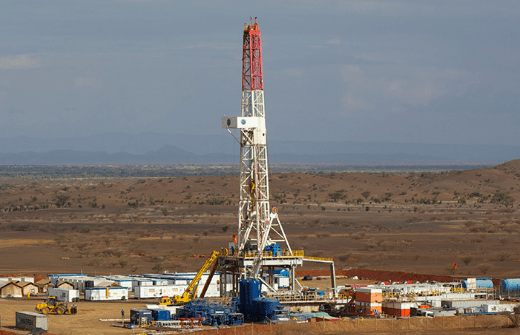

Tullow Oil is now casting serious doubts on whether it will be able to commercially produce oil in Kenya by 2022 or not as the British company cites delays in the signing of key agreements with the government.

It also says that there has been continued lack of access to land and water that would enable it to get into the final phase of the project another reasons for the delay.

Tullow reported a loss for the year to December 2019 and the losses worsened amounting to $1.7 billion (Sh170 billion) from a profit of $85 million (Sh8.5 billion) in the year 2018.

Is Tullow oil sincere about the oil finds in Turkana or it was a big lie

On Thursday Tullow cautioned that the slump in oil prices might dampen the planned sale of some of its assets in Africa, including Kenya, where it plans of selling half of its stake in the Turkana oil blocks.

In its financials for the year to December 2019 it raised concerns over continued delays in the Kenyan project and doubted the project’s ability to reach the Final Investment Decision (FID) in 2020.The FID was set for 2019 but pushed to 2020 and is expected to see the joint venture partners (including Total and Africa Oil) commit resources and agree on how to award of key construction contracts.

It is only after reaching the FID that partners can award contracts for major aspects of the project as pipeline construction and also commence development of the oil field.

Tullow has over the time complained that land acquisition for various aspects of the project and access to water that would be used in oil production had not moved at the pace they expected.

The firm expects to draw water from Turkwel Gorge and a combination of these factors and financial challenges the firm is facing have cast doubt if the project will commence commercial oil production by 2022.

“The progress has been slower on some work streams such as access rights to land and water use and the long-form commercial agreements to be entered with the Government of Kenya and this slow progress means that the target of reaching FID by year-end 2020 will become more challenging.” Tullow said.

It also cast doubts on its continued stay in the country. In early December the firm kicked out its then chief executive and the director of the exploration and right now the firm has plans to lay off staff in its operations in Kenya to cut spendings.