The Sacco Societies Regulatory Authority (SASRA) released the ranking of best performing Savings and Credit Cooperative Societies (SACCOS) in Kenya.

SASRA is responsible for licensing and supervising Deposit Taking Sacco Societies.

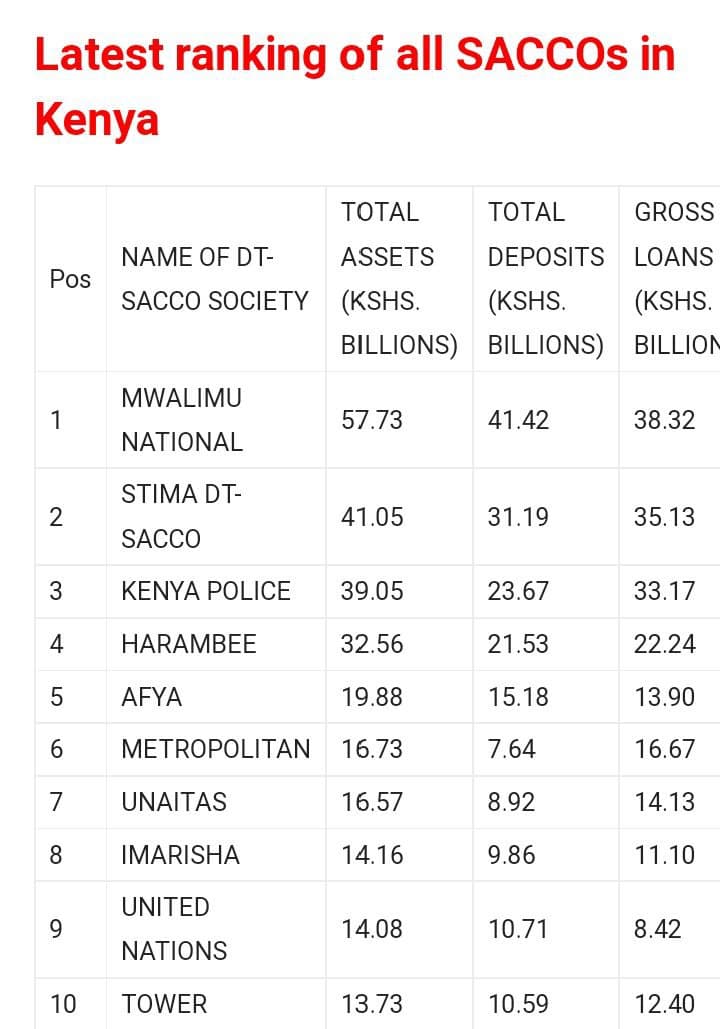

According to the list, Mwalimu National SACCO (MNS) is number one.

The teacher owned Sacco remains the largest Deposit Taking, DT, SACCO in the country by total assets’ size which was posted at Sh57.73 Billion in 2020 compared to Sh52.73 Billion posted in 2019 and representing a 10.96% growth rate over the same period.

Stima Sacco came in at second position with a total asset base of Sh41.05 Billion. At position three is the KENYA POLICE SACCO with an asset base of Sh39.05 Billion.

The comparative analysis also reveal that M/S Trans-Nation SACCO Society Ltd, which has its head offices in Chuka Town, Tharaka-Nithi County registered the highest growth in total assets with a growth rate of 29.57% in 2020, which also saw it move from position 31 in 2019 to position 26 in 2020 among the large-tiered DT-SACCOs.

It thus displaced M/S Tower SACCO Society Ltd with head offices in Nyandarua County which had in 2018 and 2019 registered the fastest growth rates in total assets.

Metropolitan National Sacco is sixth in the list of best performing Saccos with a total asset base of Sh16.73 billion. The Sacco conducts a weekly financial literacy program dubbed Metro Business Café.