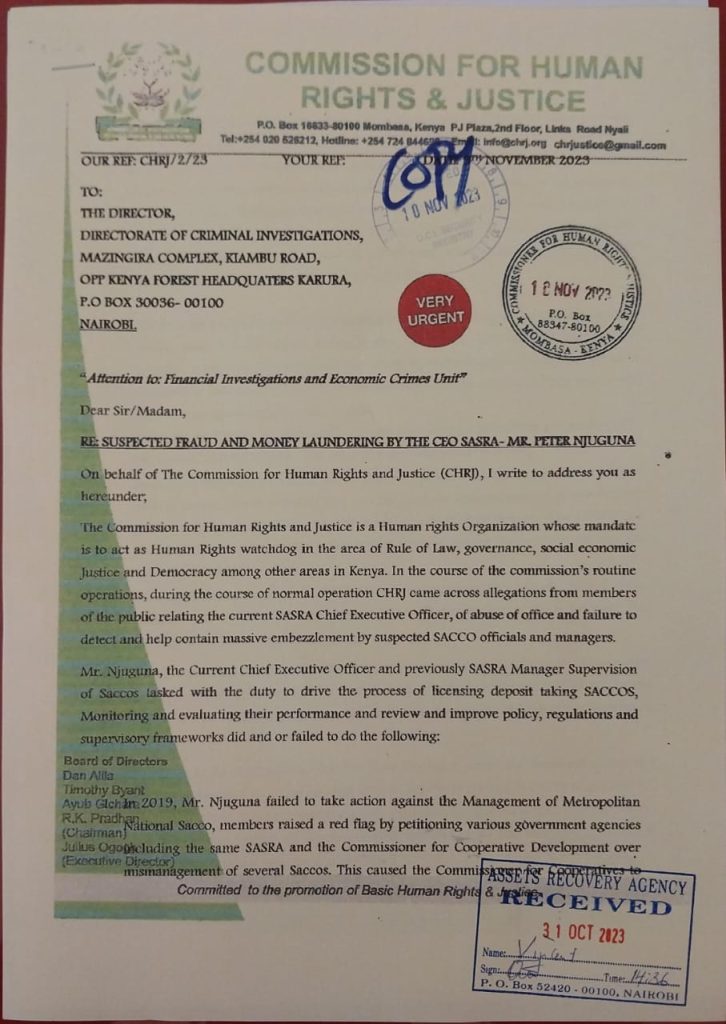

In a recent turn of events, alarming accusations have surfaced regarding the conduct of Mr. Njuguna, the CEO of the Sacco Societies Regulatory Authority (SASRA).

The fraud and money laundering by SASRA CEO Peter Njuguna, which has now become public knowledge, shed light on a series of corrupt practices that have significantly impacted the financial well-being of numerous Savings and Credit Cooperative Societies (Saccos) and their members.

In light of recent revelations concerning the financial losses within Savings and Credit Co-operative Societies (Saccos), we find it imperative to address the serious corrupt dealings directed at SASRA CEO Peter Njuguna.

The reports suggest a significant loss of credibility and financial stability within the regulatory authority under Mr. Njuguna’s leadership.

The reported loss of Sh118.1 million over the past two years, attributed primarily to fraudulent activities, is a matter of great concern. These financial discrepancies, involving staff members, have transpired under Mr. Njuguna’s watch.

As the head of the Sacco Societies Regulatory Authority (SASRA), Mr. Njuguna holds a position of considerable responsibility and trust. And he only follows his stomach and cases that align with his political Godfathers.

Furthermore, the disclosure of these losses, along with an additional suspected Sh114.4 million, has raised questions about the effectiveness of SASRA’s internal control mechanisms under the incompetent Mr. Njuguna’s tenure.

The regulatory authority, overseeing 359 Saccos with a total deposit base of Sh620.45 billion, must be held to the highest standards of transparency, accountability, and financial oversight.

Fraud by SASRA CEO Peter Njuguna within Saccos

A comprehensive audit of several Saccos has revealed a disturbing pattern of corruption and mismanagement.

The findings, now in the public domain, paint a grim picture of financial impropriety, illegal acquisition of properties, and denial of essential services to Sacco members.

Criminals are exploiting inadequate internal safeguards and mobile financial services like M-Pesa to perpetrate theft within an industry that is yet to see the realization of an insurance program aimed at shielding depositors from such financial losses.

In a specific incident, Sasra documented that in June of the previous year, an illicit withdrawal amounting to Sh29.4 million occurred from certain members’ savings accounts using unregistered mobile phone numbers. Subsequently, the funds were transferred to M-Pesa accounts.

In a separate occurrence reported in October, another Sacco brought to light an internal staff member who illicitly linked members’ savings accounts to unauthorized mobile numbers, resulting in the withdrawal of Sh1.6 million.

During the same month of October, an unusual case unfolded where an individual entered a commercial bank, established an account in the name of a Sacco, and accessed loans totaling Sh1.16 million.

Sasra details, “An unidentified individual, purportedly on behalf of a Sacco, deceptively initiated the opening of an account at a branch of a commercial bank in the name of the complainant. Subsequently, this person borrowed money from the Sacco, directing the funds to be deposited into the newly created account.”

Denial of Access to Loans and Dividends

Before his appointment as the CEO of SASRA, Mr. Njuguna, along with a group of allegedly corrupt former managers and directors of Saccos, reportedly collaborated to deny over 75,000 members access to crucial loan facilities and dividends.

Furthermore, it is claimed that these officials engaged in concealing illegal and corrupt dealings, particularly in land transactions.

Properties were allegedly acquired without due process and, in some instances, without the approval of Sacco members.

Money Laundering by SASRA CEO Peter Njuguna

Since assuming the role of SASRA CEO, Mr. Njuguna has amassed considerable wealth.

Properties, including houses in prestigious areas like Runda and Muthaiga, as well as extensive lands in Limuru and Naivasha, have been acquired.

The ownership of these assets, registered in the names of family members and close associates, is suspected to trace back to Sacco funds.

Auctioning of Licenses to the Highest Bidders

Under Mr. Njuguna’s leadership, disturbing insights have revealed that SASRA licenses and license applications are auctioned to the highest bidders, irrespective of whether they meet legal requirements.

Before his elevation to the position of CEO SASRA, Mr. Njuguna together with a number of corrupt and rogue former managers and directors of Saccos worked in cohort to deny more than 75,000 members access to loan facilities and dividends. Thereafter the officials moved to conceal illegal and corrupt dealings especially in land. Several SACCO properties were never illegally acquired, and in some cases, properties were purchased without members approval, yet he still gave it a deaf ear.

Specific instances involve demands for exorbitant amounts, such as Kshs. 100,000,000 from an undisclosed Sacco, with Kshs. 75,000,000 allegedly already received.

Another case involves a demand for Kshs. 50,000,000 from a different Sacco, with Kshs. 50,000,000 reportedly paid.

After his ascension to the position of CEO SASRA Mr. Njugiina has amassed a lot of wealth, these include houses within Runda, Muthaiga, vast lands in Limuru and Naivasha. If a thorough investigation is carried out on these properties, most of which is registered in the names of his family members and his close confidants, their source will take the investigators baclc to Sacco funds.

Under his leadership as SASRA CEO, licenses and license applications are auctioned to the highest bidders, whether they meet the legal requirements or not;

He recently demanded for Kshs. 100,000,OOO/= (Kenya Shillings One Hundred Million from a Sacco, (Name withheld and can be given on request, subject to our sources protection) and received Kshs. 75,000,000/ (Kenya Shillings Seventy-Five Million) for purposes of issuing this particular Sacco with a license, despite the Sacco not meeting the legal.

Call for Investigation and Legal Action

The insiders and verified sources possess substantial evidence, including witness statements and whistleblowers willing to testify against the fraudulent dealings by SASRA CEO Peter Njuguna.

They assert that these audit reports meet the criteria set by the Proceeds of Crime and Anti-Money Laundering Act of 2009.

We also wish to put it on record that, we have all the necessary witnesses and evidence to support our allegations, including but not limited to producing orrr whistleblowers to record statements with your office. On condition that their confidentiality, anonymity and witness protection is guaranteed.

We are aware, as an organization, that the facts alluded to, meet the threshold under the provisions of the Proceeds of Crime and Anti-Money Laundering Act of 2009. To which end we call upon your office to conduCt investigations in Relation to the said allegations and take all the necessary legal action against all the perpetrators whose actions and inactive led to members of SACCOS losing their hard-earned cash

Consequently, they urge relevant authorities to conduct a thorough investigation into the allegations and take appropriate legal action against those responsible.

They have requested that DCI act swiftly, nab the fraudulent Peter Njuguna and his cronies within SASRA, and seal the corruption loopholes they have dug.

As concerned citizens and stakeholders in the financial sector, it is imperative to address these allegations promptly and transparently to uphold the integrity of Saccos and regulatory bodies.

The allegations, if proven true, not only compromise the financial stability of Saccos but also erode public trust in regulatory institutions.

The onus is now on investigative bodies to meticulously examine the evidence presented and ensure that justice prevails.