The East African Development Bank (EADB) has filed the case before a London court seeking to auction Jubilee SG Raphael Tuju’s Karen-based Dari Restaurant to offset the Sh1.4 billion loan and it’s interest.

According to EADB, the debt, which it advanced on July 31, 2015 at Sh951m), has remained in default since 2017 when it fell due. Tuju was busy campaigning for his boss.

The bank says Tuju’s Dari Restaurant has blocked their communications and have appealed local cases forcing the bank to seek enforcement. By this we mean a possible auction.

Court documents seen by Kenyan Bulletin revealed that the restaurant entered into an agreement with the bank on April 10, 2015, under which it agreed to give Dari a Sh962 million loan.

Raphael Tuju and a firm known as S.A.M Company Ltd signed a deal under which they promised to guarantee the payment obligations on a full indemnity basis.

According to court documents filed at the Queen’s Bench Division of the High Court of Justice of England and Wales, the bank said it had advanced Dari $9.19 million (Sh951.6 million) on July 31, 2015.

The documents further showed that $102,916 (Sh10.6 million) , which was part of the deal, was cancelled.

In the agreement, the restaurant allegedly agreed to repay the loan in 20 consecutive installments. But the deal gave the restaurant a 24-month grace period, which fell due in 2017.

But two years later, Dari had failed to pay $1.8 million (Sh186 million) in interest owed, according to the bank, adding that Dari Restaurant had ignored a notice to clear the debt.

Among the accusations the defendants face were breach of agreement and defaulting in loan repayment.

EADB accused the hotel, where Mr Tuju sits as a director, of breaching the debt agreement and defaulting on the loan.

The judge also dismissed Dari’s counterclaim, which stated that the interest rate charged by the bank was a penalty that was not unenforceable.

The judge disagreed, ruling that it was a standard clause in loan agreements of the type advanced to the hotel.

“The court is in a position [to conclude] that the rate of default interest is not penal and that the proposed defence does not have a real prospect of success,” the judge ruled.

The bank accused the four guarantors, including Mr Tuju, of failing to make sure that Dari complied with its financial obligations in line with the terms of the loan, adding that they were in breach of their own obligations.

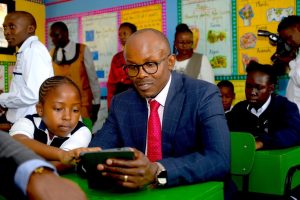

Mr Tuju, who made his wealth from the media business and who has invested heavily in real estate, is a Cabinet Secretary as well as the ruling Jubilee Party’s Secretary-General.