Centum Plc, a listed investment business, will seek a waiver of a share buyback regulation that limits the amount of shares it may acquire in a single trading day in order to maximize the outcome of its planned Sh600 million stock repurchase plan in the face of a slow market.

The firm said it will seek an exception from a Capital Markets Authority (CMA) rule that prohibits any corporation buying back its holding from purchasing more than 25% of its equities in a single day, citing low trading volumes on the Nairobi Securities Exchange.

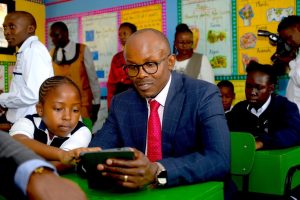

“There are two things that are prescribed by the guidelines. One is the price range and the second is the volume of daily traded shares that the firm can buy. It is 25 per cent or any other percentage as may be prescribed by CMA and that is what we will be seeking exemption for because, given the very low trading volumes, 25 per cent may be very low,” Centum Plc executive officer, James Mworia told Daily Nation in an interview.

Centum plans to buy back up to 10 per cent of its shares from the market, translating to 66.5 million shares, at a maximum price of Sh9.03 apiece share which translates to a 10 per cent premium over the weighted average price of the last 30 days.

A share buyback occurs when an issuing company pays shareholders the market value per share and re-absorbs that portion of its ownership that was previously distributed among public and private investors.

A company could repurchase its stake for various reasons including reducing the cost of capital, ownership consolidation, preserving stock prices, undervaluation, and boosting its key financial ratios. Despite its current heavily discounted share, Centum said it is not on a mission to turbocharge its share price.

“We are not on a mission to rescue the share price. What we have seen from the Nation Media Group share buyback is that even if you buy at a higher price, the share price can still drift back and this meant that value was transferred from the remaining shareholders to the existing shareholders. This is why we want to stick to the prescription of the regulation around 10 per cent above the average weighted price. All we are doing is availing liquidity,” said Mworia.