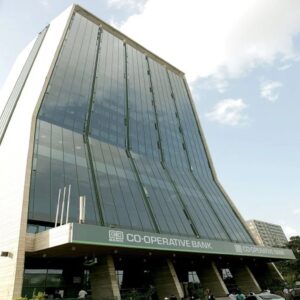

Co-operative bank of Kenya has secured Kshs. 8.25 billion ($75 million) for onward lending to the Micro Small and Medium Enterprises at affordable terms.

The long-term loan has a tenure of 7 years, coming in as a tier two supplementary capital and would target startups in sustainable agriculture and renewable energy and Co-operative Bank will apply the proceeds of the facility to support customers to better cope with the disruptions brought about by COVID-19 pandemic.

“The funding has come at a most opportune time as it boosts our ability to better support our MSME customers to stabilize and turn around their business to meet the challenges brought about by the pandemic,” said Co-op Bank Group CEO Dr. Gideon Muriuki.

The lender has leveraged its strong balance sheet with total assets at Kshs. 510 billion (as of 30th September 2020) and the IFC facility is expected to enhance the bank’s opportunities for growth and overall performance.