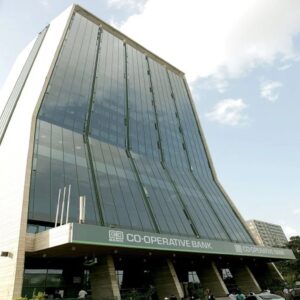

The Co-operative Bank of Kenya (Co-op Bank), will benefit from a long-term syndicated loan of US$15 million from the Swedish development bank -Swedfund.

The Kenyan top tier lender will use the resources to increase its support to Small and Medium Enterprises (SMEs) and finance green projects.

“We have an important role in supporting strong and healthy financial institutions like Co-operative Bank to help them to continue lending to local businesses and entrepreneurs. By providing long-term funding to Co-operative Bank that has its background and a strong footprint in rural areas with a clear and focused agenda for SMEs – and green finance we can support inclusive and sustainable growth, in particular in the currently challenging environment,” said Maria Håkansson, Head of Swedfund.

This new credit line is part of an overall US$75 million financing mobilized by the Kenyan bank from a consortium, led by the International Finance Corporation.

Maria Håkansson – Head of SwedFund

The money will also strengthen the bank’s capital.

Over the first half of 2020, Co-op Bank granted loans up to US$2.4 billion to its clients, higher than the US$2.34 billion granted the same period in 2019.

Last month, the International Finance Corporation (IFC), the private sector arm of the World Bank has given Co-operative Bank of Kenya US$75 million loan for onward lending to micro, small and medium-sized (MSMEs) firms crippled by the Covid-19 pandemic.

The bank announced that the International Finance Corporation (IFC) loan will come in as a tier II supplementary capital and will be repaid within seven years.

The bank in August 2018 also rolled out a US$150 million partnership programme with IFC, to provide affordable financing and business training to Kenyan MSMEs.

Over 110,000 customers in Kenya had taken up the MSME loans amounting to US$134.4 million at the end of September last year while another 8,950 entities had been trained on business management and planning.