Average rental yields softened across all sectors in Kenya according to a report by Cytonn, coming in at 7.4, 7.3 and 5.1 percent, for retail, office, and residential sectors, respectively, from 7.7, 7.8 and 5.2 percent in Q1’2020.

The land sector recorded an overall annualized capital appreciation of 1.4 percent, with asking land prices in low rise residential areas recording the highest annual growth at 3.8% driven by the increased demand for affordable land.

According to the report, constrained financing, supply chain constraints, and reduced revenues arising from slow market uptake and downward pressure on prices and rents due to the ongoing COVID-19 pandemic are expected to remain as the main challenges facing the real estate sector.

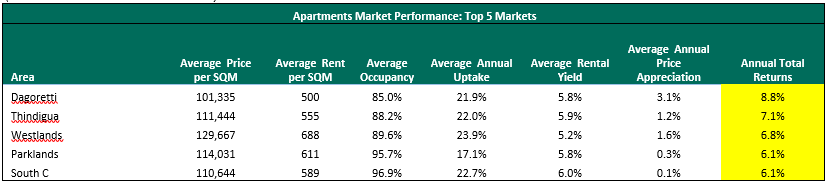

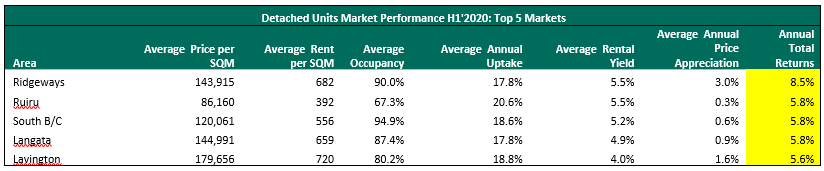

“The residential sector remained relatively stable with most sectors softening in performance, albeit marginally. Dagoretti, Ridgeways, and Westlands recorded the highest annual price appreciation at 3.1, 3.0, and 1.6 percent, respectively”, said Wacu Mbugua, Research Analyst at Cytonn.

In commercial real estate, Gigiri, Karen, and Westlands were the best performing office nodes in H1’2020 recording rental yields of 8.9, 8.3, and, 8.2 percent.

The areas have a superior location and availability of top-quality offices, enabling them to charge a premium on rental prices, while in the retail sector.

Westlands and Karen were the best performing retail nodes with average rental yields of 9.8 and 9.2 percent.

Of the six sectors, our outlook is positive for one – land; neutral for three – residential, retail and hospitality; and negative for two – office and listed real estate.

“Thus, our outlook for the real estate sector remains neutral. Going forward, we expect the industrial sector, residential, land, and select office markets to continue holding up well in terms of performance, while retail and hospitality remain the most affected. The sector’s performance should improve significantly towards the end of 2020 once economic activity regains momentum,” said Cytonn.

Via Soko Directory