Late yesterday, The DCI dismissed a complaint by part owner of Bluebird Aviation that his partners have siphoned more than $1 billion (Sh103 billion) from the airline through tax evasion, fraud and money laundering.

Late yesterday, The DCI dismissed a complaint by part owner of Bluebird Aviation that his partners have siphoned more than $1 billion (Sh103 billion) from the airline through tax evasion, fraud and money laundering.

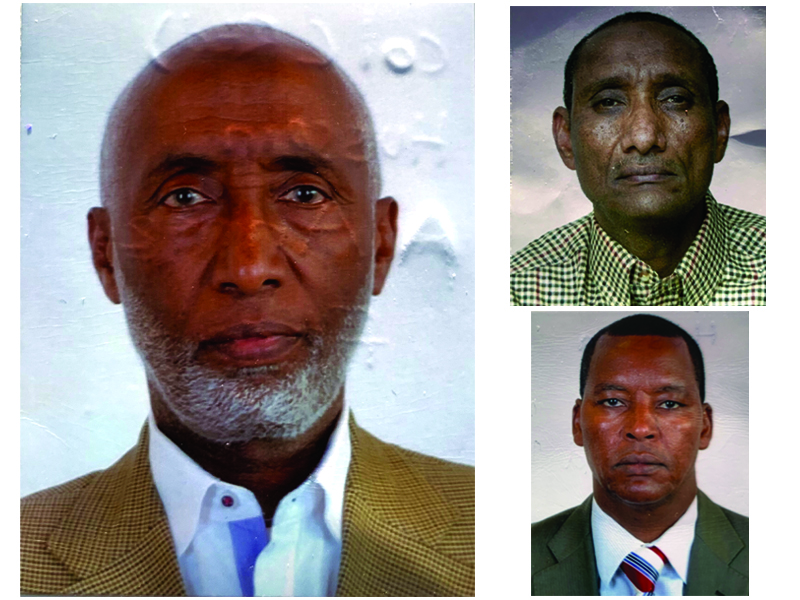

Filings in court show that the DCI has cleared three shareholders and executives of Bluebird — Hussein Farah, Unshur Mohamed and Mohamed Abdikadir from financial malpractices after a nine-month investigation.

The investigation followed a criminal complaint from Bluebird Aviation part-owner Yussuf Adan against his fellow shareholders, accusing them of fraudulently channeling massive funds out of the company as part of a money-laundering scheme.

He sought the DCI to probe Mr. Farah, Mr. Mohamed, and Mr. Abdikadir — for fraudulent accounting, tax evasion, fraud and money laundering.

“The investigations have not established facts that may warrant the mounting of a prosecutable criminal case. The complainant did not provide the foundation for his allegations … and where he made claims, we found those claims far-fetched.” John Kariuki, director of the Investigations Bureau at the DCI said in the clearance notice filed in court on August 28.

The DCI says the clearance notice was the product of investigations by other State agencies, including the Central Bank of Kenya, Kenya Revenue Authority (KRA), Kenya Airports Authority (KAA), Kenya Civil Aviation Authority and Financial Reporting Centre, which tracks illicit money.

Mr. Yussuf, who claims to own 25 percent of the charter airline, has in the past three years been locked in a vicious court fight with the trio for control of the 27-year-old firm with a fleet of more than 21 planes.

He argues that more $1 billion (about Sh103 billion) has been stolen from the airline in its 27 years of operation and put in offshore accounts and investments in Western capitals after being transported physically out of the country without a declaration.

He said the three directors were using the airport passes granted for restricted areas in airports to move the billions. The DCI dismissed the secret movement of cash at the airports, arguing its investigation and investigations by KAA found no evidence of money laundering.

The Financial Reporting Centre through the DCI said it failed to detect breaches while tracking the flow of cash in and outside Blue Bird Aviation. The center added that the airline’s bankers — Commercial Bank of Africa — had never flagged any suspicious transactions linked to Blue Bird.

The DCI reckons that the Kenya Revenue Authority reviewed the books of Blue Bird and failed to detect tax evasion through false accounting.

The KRA is said to have reviewed Blue Bird bank accounts and financial dealings going several years back and matched bank deposits and payouts against daily revenue collections for several months to detect suspicious transactions.

“KRA assessment was that the company was tax compliant and that there was clarity and high level of financial documentation,” said the DCI.

Mr. Yussuf had also made similar claims of financial crime in a court suit where he sought to wind up Blue Bird Aviation. He has since moved to the Supreme Court after failing to have a High Court decision that rejected the petition overturned on appeal.