[ad_1]

Growing appetite for collapsed banks by Kenyan subsidiary of the Mauritius based lender, State Bank of Mauritius (SBM) and dirty secret loan deals flagged by the Central Bank of Kenya (CBK) bares the hallmark of a consistent operational pattern by the lender.

Besides what insiders described as a designed collapse and takeover of the then struggling Fidelity and Chase Banks, The Informer can authoritatively the lender is angling for a similar buyout of the troubled Rafiki Microfinance Bank currently marred by internal infighting amongst senior managers amid ongoing final buyout negotiations with the Mauritius investor.

Rafiki was owned by the collapsed Chase Bank.

Rafiki was owned by the collapsed Chase Bank.

Rafiki has now tapped its Chief Finance Officer (CFO) Paul Karanja Macharia to the helm of the CEO post in acting capacity.

Macharia has previously worked at Equity Bank and Chase Bank (Finance Departments) and was a Finance Manager at Chase Bank before joining Rafiki in 2016.

Fears are rife Rafiki Bank could face similar fate as Chase Bank to form basis of what insiders termed as “favourable takeover” by the Mauritius lender at a distressed sale value.

Fresh details have now emerged how SBM secretly took a Sh9.6 billion interest-free loan from CBK during the purchase of collapsed Chase Bank assets and deliberately refused to reveal its agreements with the banking sector regulator and the Kenya Deposit Insurance Corporation (KDIC) over the purchase of Chase Bank.

Fresh details have now emerged how SBM secretly took a Sh9.6 billion interest-free loan from CBK during the purchase of collapsed Chase Bank assets and deliberately refused to reveal its agreements with the banking sector regulator and the Kenya Deposit Insurance Corporation (KDIC) over the purchase of Chase Bank.

Consequently, the tax tribunal has quashed an appeal by SBM to stop the Kenya Revenue Authority (KRA) from claiming the payment and ordered SBM to pay Sh400 million in taxes and penalties for the irregularly obtained secrete Sh9.6billion loan.

SMB Bank suffered a major blow after the tax tribunal dismissed its appeal to stop KRA from claiming the payment.

The tribunal observed that SBM declined to give proof of payment for the acquisition, analysis, and valuations of the assets and liabilities taken over and supporting documents for the Sh9.6 billion facility.

“The tribunal finds that SBM failed to furnish KRA and this tribunal with crucial documentation which would have helped in determining whether the amount described in SBM’s financial statement as ‘other income- balances due to CBK’ could be interpreted as other fees to be charged excise duty…As such, the tribunal finds that SBM has failed to adequately challenge the assessment raised by KRA.” The tribunal led by Patrick Lutta said.

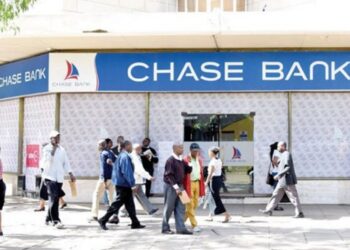

Chase Bank collapsed in 2016.

SBM did a ‘carve out acquisition’ of over 75 per cent of the failed lender’s assets and liabilities.

“We did carve out acquisition of Chase Bank Limited. In effect, we took partly assets and partly liabilities. We did not take over the entire assets and liabilities of Chase bank.” Our source added.

However, details of the transactions remain a closely guarded secret and the claim by government collector has shed light on some of the arrangements that facilitated the expansion of the Mauritius lender into the Kenyan market.

SBM took over Fidelity Bank in May 2017 and currently has at least 46 branches across the country with an asset base of Sh800billion.

SBM took over Fidelity Bank in May 2017 and currently has at least 46 branches across the country with an asset base of Sh800billion.

[ad_2]

Source link