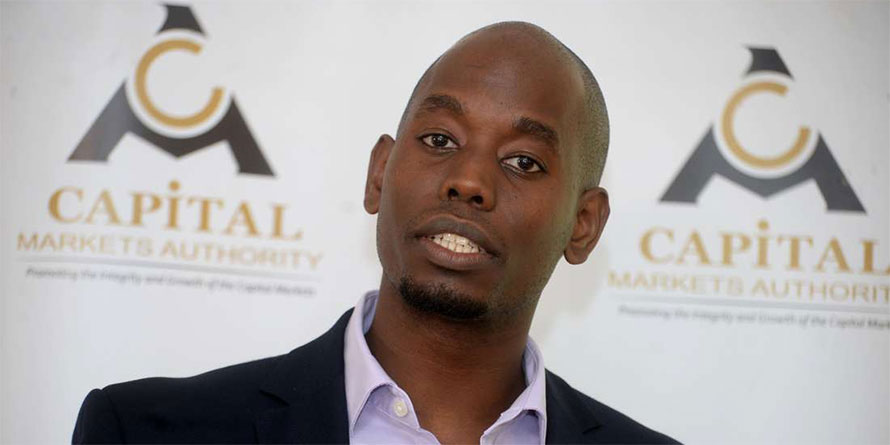

Current Capital Markets Authority (CMA) chairman James Ndegwa has appointed Paul Muriithi Muthaura, the former CMA CEO as the chief operating officer (COO) of ICEA Lion Insurance, a firm associated with the former.

The post was recently created to accommodate the lawyer, who has been out in the cold without a job since he left CMA in December 2019.Mr. Muthaura takes the reigns at ICEA Insurance having had no insurance or any private sector operations experience.

Under his regime, CMA is considered to have recorded some successes such as listing of the NSE and bringing orderliness to brokers. However, he also had a very stinky record such as letting a few banks take control of the CMA, the chairing of CMA by a market participant happened under his watch, and during his tenor investors lost tens of billions in CMA approved products such as Imperial Bank and Chase Bank Bonds, Uchumi and Mumias shares, Genghis Money Market and Amana Money Market Funds.

CMA also spent hundreds of millions of taxpayers monies hiring foreign consultants from London, Australia and Johannesburg to churn out totally useless products such as asset-backed securities, Development REITs, future exchanges, ETFs, gold exchanges, in the name of innovations.

This appoint also comes as a conflict of interest, as Ndegwa is the owner and chairman of ICEA Lion Insurance, and has served together with Muthaura as CEO

Worse still, the insurance company runs the ICEA money market fund, an arm regulated by the CMA As experts would argue, CMA as currently constituted does not regulate the ICEA money market but instead protects it.

ICEA Lion General Insurance made an underwriting profit of Sh283.4 million last year.

Muthaura has worked with the CMA for 14 years, and his appointment is seen as a way of keeping him inside CMA through the underwriter whose owner is the chairman of the regulator.

James Ndegwa is affiliated to three money market funds- ICEA money market fund, NCBA money market fund, and Stanlib Money market fund.

Muthaura will start serving in the newly created position on May 1.