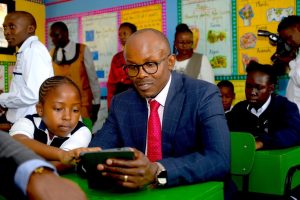

A Financial Technology (FinTech) startup founded by banker Jasper Ochieng started operations a few years ago and intends to make most Kenyan businesses, both big and small go green.

Kibo Capital Group Limited which offers among other things, payment records management systems, has signed up a couple of Kenyan firms to its green e-receipts service.

Over the past 10 years, Kenyan Financial Technology (FinTech) space has been growing thanks to great ICT laws enacted during the Kibaki-era.

These days, many people see no need of going to the bank anymore as they can use their phones to transact. From paying for services, withdrawing and depositing money from and to banks, purchasing electricity, life has become easy for Kenyans.

It is for this reason that Kibo’s PaymentGate service was born.

The founder saw that many Kenyans at the shops, supermarkets and banks would throw away the receipts immediately after making a purchase; and this was detrimental to the environment.

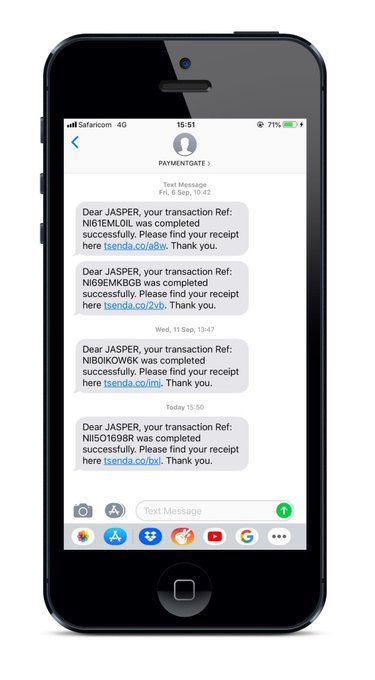

The other issue was that after an MPESA or a bank payment that is linked to the Short-Message Service; a client might erase the text message by mistake; which makes it hard for them to track their payment records in case they wish to lodge a complaint.

Benefits

The benefits of signing up to the PaymentGate products are many, apart from automated reconciliation for the business, where human error is minimized in book entries; Customers can also click on a link on the receipt and leave their feedback.

“The receipting solution avails Universally Verifiable electronic receipts for both Mobile Money payments and banking deposits at branches, online banking or via Paybill”, the company says on its website.

How it works

1. Your Customer makes a payment Using your mobile money (Paybill or Buy Goods or swipes using a credit or debit card).

2. The Customer receives a Text on their mobile phones (second step only if using MPESA or banks that send text notification on transactions).

3. The client receives a (second) text from PaymentGate with a link to a receipt. When they click on the link. A receipt like the one below appears, where you can advertise new products. The receipt has a verification mechanism.

‘The benefits are many, apart from having great records management; advertising on the e-receipts, businesses are also guaranteed to save on their stationery costs as the solution removes the necessity for physical printouts. This also means that one doesn’t need boxes and safes and big rooms to keep storing the receipts’, says Jasper.