The government has stepped up its efforts to sell its stake in Kenya Airways to a strategic investor.

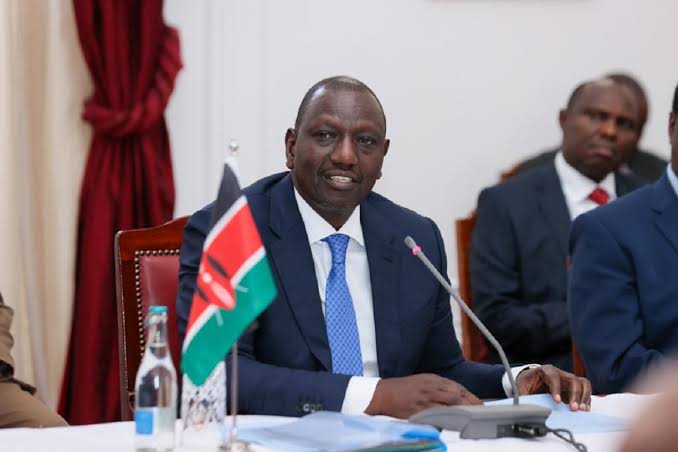

This follows a meeting between President William Ruto and top executives of the United States largest carrier Delta Air.

The meeting between President Ruto snd executives from Delta Air Lines Inc was held on Thursday.

It followed President Ruto’s remarks that his government was willing to have a strategic investor take over the ailing national carrier.

“I’m willing to sell the whole of Kenya Airways Plc. I’m not in the business of running an airline that just has a Kenyan flag, that’s not my business,” President Ruto had told Bloomberg News on the sidelines of the US-Africa Leaders Summit in Washington DC on Friday.

He had added that discussions with Delta were at a preliminary stage.

“The government is looking for partnerships that will make Kenya Airways a profitable entity whatever that means, in whatever configuration, whatever form it takes.”

The possible deal will see the government cut its shareholding from 48.9 per cent and reduce the ownership of local lenders who converted their debt to a 38 per cent stake.

Currently, Air France-KLM owns a small stake in Kenya Airways.

The national government sold a 26 per cent stake in KQ to KLM in 1995. It then sold a 22 per cent stake to local shareholders through an initial public offering at the Nairobi bourse in 1996.

The deal offered KLM seats on the KQ board, the right to appoint certain executives, in particular the chief finance officer, and act as the technical partner for the national carrier.

KLM has since reduced its stake from 26.7 per cent after the conversion of State debt and bank loans to equity diluted the firm’s ownership to 7.76 percent.

“We are doing everything possible to ensure that we no longer subsidize the airline and that is why we are looking for a strategic partner,” Transport Cabinet Secretary Kipchumba Murkomen said.