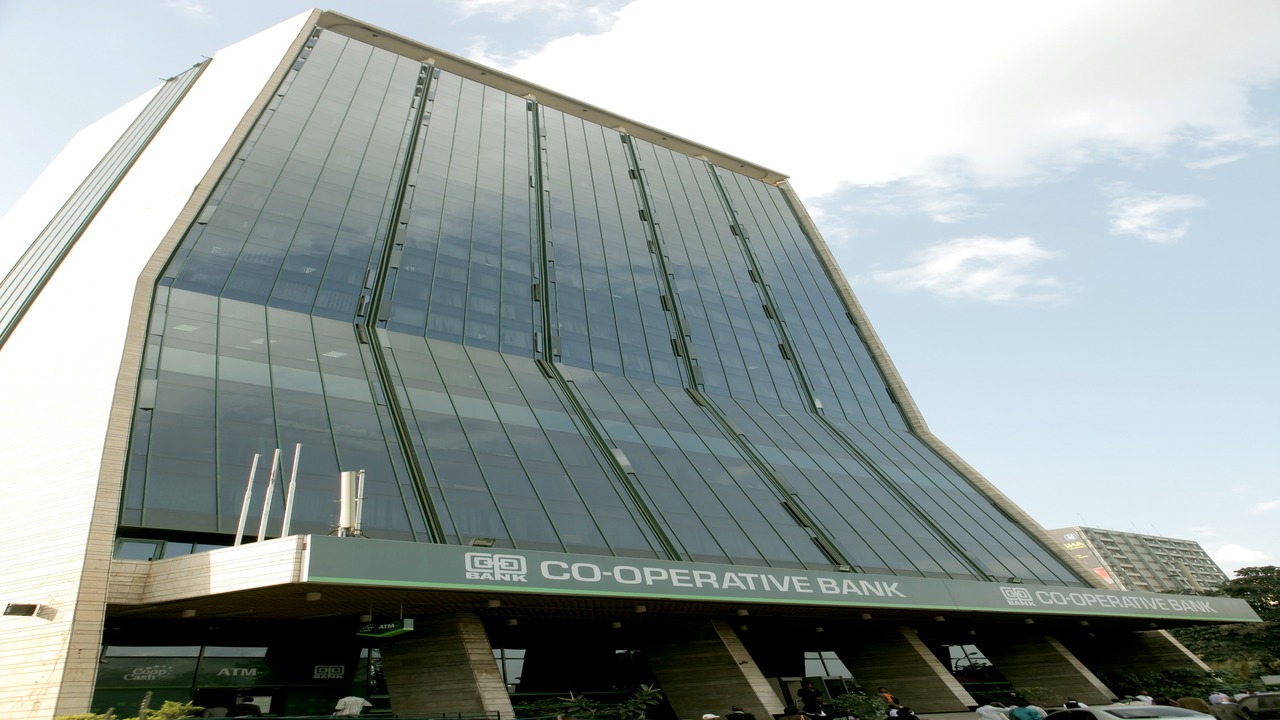

Two more Kenyan lenders have broken into Africa’s top 25 banks, with Co-operative Bank and NCBA joining KCB and Equity in a list traditionally led by West and Southern African institutions.

Data from The Banker magazine, a Financial Times publication, places the four Kenyan lenders among the continent’s fastest-growing.

KCB recorded a 54.9 percent expansion in Tier 1 capital, securing position 13 in Africa.

Co-op Bank followed closely with 39.2 percent growth, earning rank 22.

Equity grew by 38.4 percent to take position 15, while NCBA, with 32.2 percent growth, entered at number 25.

Globally, the four banks were ranked within the top 1,000: KCB at 572, Equity at 590, Co-op Bank at 864, and NCBA at 924.

The rankings weigh several indicators — among them capital strength, profitability, asset quality, and operational efficiency.

Co-op Bank stood out in return on assets, recording 3.43 percent, which placed it fifth continent-wide in balance sheet deployment.

This comes as Kenyan lenders continue expanding across the East African region, leveraging digital platforms and underserved markets.

While banks from West Africa maintain strong capital positions, several lost ground in the latest rankings. Access Bank slipped from 14th to 18th, and United Bank for Africa dropped four spots to 20th.

By contrast, the performance of Kenyan banks reflects momentum in regional markets such as Uganda, Tanzania, South Sudan, and DRC, where financial penetration remains relatively low and growth margins wide.

The country’s banking sector continues to draw interest from global institutions. Standard Bank, Absa, and Morocco’s Bank of Africa all operate locally through subsidiaries. Zenith Bank of Nigeria, which also featured in the list, has signalled plans to enter Kenya through acquisition.

The broader trend signals a shift in regional banking influence, with Kenyan lenders now challenging legacy dominance in African finance — not through scale alone, but through return metrics, adaptability, and regional integration.