M-Pesa has transformed how millions of Kenyans handle money daily, thanks to its accessible and secure approach to mobile transactions.

This service by Safaricom has seen its user base expand quickly, making it an essential part of the economy.

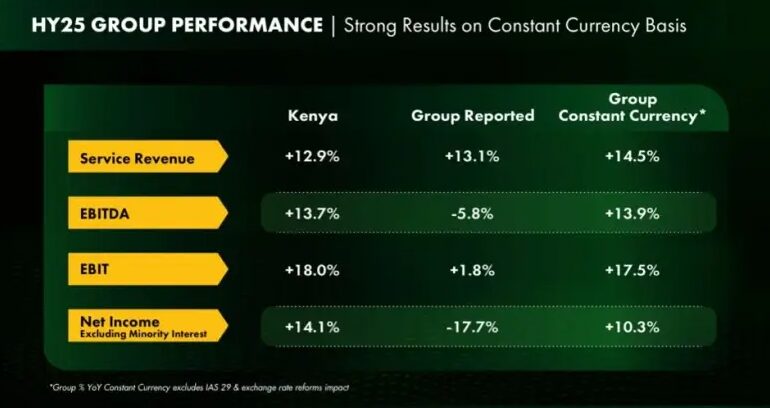

Safaricom’s H1 2025 results show that M-Pesa remains a core element of its financial success, reinforcing its role in Kenya’s digital economy.

In the first half of 2025, M-Pesa’s revenue grew by 16.6% from the previous year, reaching Ksh. 77.2 billion.

This rise reflects a growing demand for digital financial solutions, particularly for everyday transactions, reinforcing M-Pesa’s role in broadening access to financial services across Kenya.

Strong Growth for M-Pesa in H1 2025

Consumer payments contributed most significantly, making up 62.9% of M-Pesa’s revenue at Ksh. 48.6 billion. This high share underscores how M-Pesa has become deeply integrated into daily routines, from paying for essentials to managing utility bills. The steady increase in consumer transactions illustrates M-Pesa’s reliability in personal finance management.

Total transaction value for M-Pesa reached Ksh. 20.9 trillion, growing by 10.7%, with transaction volumes up by 30%, amounting to 17.1 billion—a clear sign of how vital M-Pesa has become for daily activities.

Expanding Services with Business Solutions

Lipa na M-Pesa, the merchant payment option, saw growth of 5.2%, totaling Ksh. 3.7 billion, indicating strengthened business use of M-Pesa. One standout performance area was Pochi la Biashara, a service for small businesses. Revenue from Pochi la Biashara rose by an impressive 229.8% to Ksh. 0.9 billion, reflecting a trend where small business owners are increasingly using mobile money to simplify transactions, manage income, and enhance business operations.

Safaricom’s H1 2025 results confirm M-Pesa as a fundamental part of Kenya’s economic structure, from consumer to small business transactions, reinforcing its impact on financial access and empowerment across the country.