A resident from Lower Kabete, Kiambu, is in search of answers from a top telecommunications company in the country after thugs who accosted him on Saturday,18th December 2021, illegally gained access to his personal financial accounts under the service provider.

Speaking on social media, Kelvin Gakuo narrated how hefty damages from his encounter with the armed robbers sharply escalated when he replaced his Safaricom line on Monday afternoon.

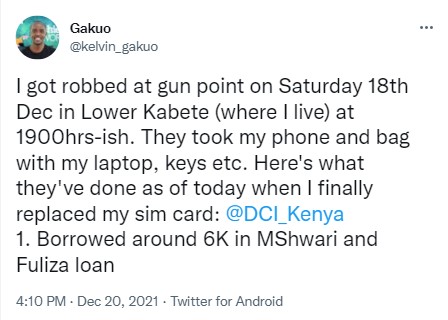

“I got robbed at gunpoint on Saturday 18th Dec in Lower Kabete (where I live) at 1900hrs-ish. They took my phone and bag with my laptop, keys etc,” he wrote.

In the viral Twitter thread, he revealed that upon setting up the new sim card, he shockingly realized that his mobile banking accounts had been severely defiled by the temporary holders of his device.

This included Sh6,000 worth of funds acquired through an M-Shwari Loan and Fuliza overdraft.

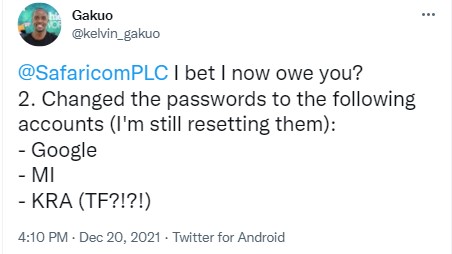

Apart from raiding his personal coffers, the suspects also changed some of his most crucial passwords.

This blocked access to his Xiaomi and Google accounts.

Interestingly, his Kenya Revenue Authority (KRA) account PIN was also affected.

“Here’s what they’ve done as of today when I finally replaced my sim card:

- Borrowed around 6K in MShwari and Fuliza loan

- Changed the passwords to the following accounts

Google

Xiaomi

KRA “ he wrote.

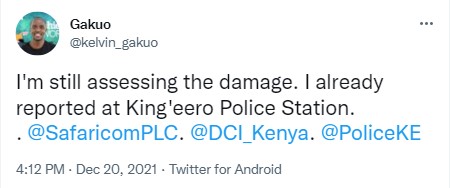

Additionally, Kelvin noted that although he is still assessing full levels of damage, he already reported the incident at King’eero Police Station in Kikuyu.

He also revealed that to his great relief, his Equity and NCBA Bank mobile accounts were not affected during the heist.

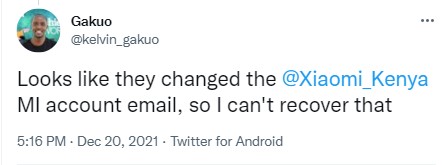

Unfortunately for him, however, his attempts to recover his Xiaomi profile proved futile since they changed his log-in details.

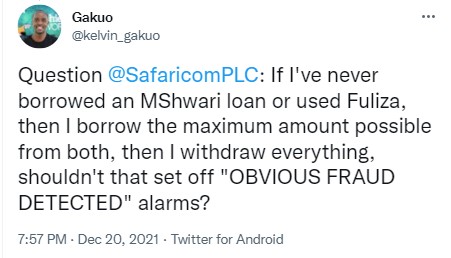

At the foot of his thread, Kelvin now wants answers from Safaricom explaining how they managed to access his accounts.

He also seeks to understand why being a long-time customer of their service, they failed to deem it necessary to flag some of the suspicious and unscrupulously conducted transactions.

“If I’ve never borrowed an M-Shwari loan or used Fuliza, then I borrow the maximum amount possible from both, then I withdraw everything, shouldn’t that set off “OBVIOUS FRAUD DETECTED” alarms?” he asked.

As of the publishing of this post, Safaricom was yet to issue an official response regarding the matter over 24 hours later.

Insecurity in the neighbourhood located in Kabete constituency has left many sustaining serious injuries, and often, their victims, just like Kelvim, are left with nothing; phones gone, wallets and so on.

It is a group of youth that has continued to wreak havoc on residents with impunity and total disregard for the rule of the law.

Strangely, some of the attacks have happened just outside the King’eero Police Station, or a few meters away.