According to data recently published by the Unclaimed Financial Assets Authority (UFAA), the total value of unclaimed assets held by the State stands at Sh13.3 billion as at the end of September 2020.

Last year, the Unclaimed Financial Assets Authority (UFAA) reported that the State had Sh10 billion unclaimed financial assets report.

According to the details, Kenyan companies and fund managers surrendered more than Sh2.7 billion in unclaimed assets and monies belonging to deceased Kenyans in the 2018/2019 financial year.

“During the year under review, the Authority scaled efforts to ensure compliance by the holders of unclaimed financial assets through the issuance of Surrender notices to all holders, began the inspection of holder’s books on reporting and instituting the necessary structures, systems and procedures to guide the process. These efforts yielded growth of the fund to the current value of Sh13.3 billion in cash, 539.77 million share units from various counters and 1,489 safe deposit boxes reported to the fund,” said UFAA Chief Executive John Mwangi in a statement accompanying the results.

For the 2018/2019 financial year the Authority spent Sh635 million from the Sh722 million budget. This included Sh157 million carried forward from the previous year, Sh207 million in direct disbursement from the exchequer and Sh354 million drawn from the Authority’s trust fund with the approval of the National Treasury.

The agency also reported Sh1.1 billion in investment income, up from Sh971 million the previous year with the money recorded as surplus that was carried forward for budgetary commitments in the 2019/2020 financial year.

According to the UFAA financial results, Sh22.9 billion worth of shares and Sh18.4 million in unit trusts have not been surrendered to the Authority, even as the fund managers have made the statutory reporting.

In its audit report on the financial results, the Office of the Auditor-General said UFAA was in breach of its mandate by failing to remit surrendered assets to beneficiaries in a timely manner.

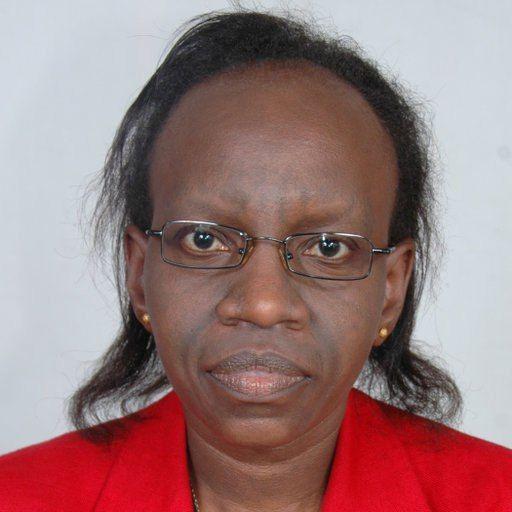

“Although there has been an improvement of the reunification rate of assets with the beneficiaries over the last three years, the rate is slow, standing at 1.5 per cent of recipes as of June 30, 2019,” said Auditor General Nancy Gathungu in her report.

Gathungu cited instances where UFAA paid claims without obtaining a certified death certificate as required in its claims policy, as well as systemic weaknesses that could fuel graft.

“From the audit of the system, there was no evidence of review of activities of privileged users’ activities on key applications, databases and supporting operating systems,” said the Auditor-General.