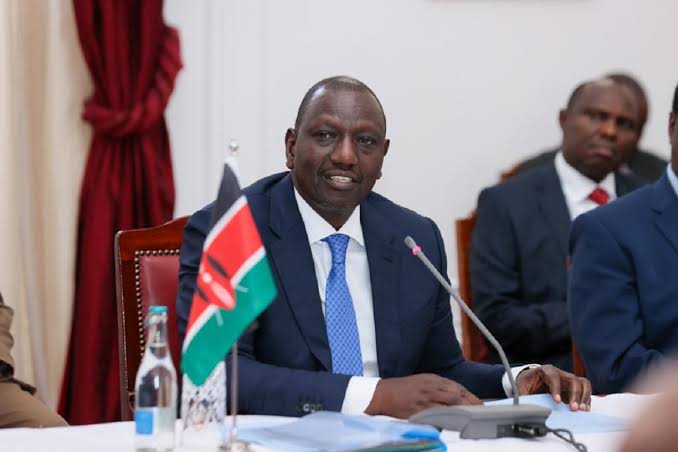

President William Ruto changed the launch date of the much-expected Hustler Fund and also set new limits for borrowers.

On Tuesday, November 15, the Cabinet approved the project in a meeting chaired by the head of state.

In a statement sent to newsrooms, Ruto set Wednesday, November 30, as the new launch date, bringing it forward from December 2022.

Members of the Cabinet also approved the legal and institutional framework for establishing and implementing the hustler fund.

Kenyans will also borrow as low as Ksh500 and a maximum of Ksh50,000.

The limit to be offered to an individual will be calculated based on one’s credit score, with each principal amount attracting an interest rate of 8% annually.

Only Kenyans who have attained 18 years and above with national identity cards and KRA pins will access the loans.

Registered groups and organizations applying for the loan should not have a turnover of more than Ksh100 million.

The fund is part of Ruto’s campaign pledges in which he promised a Ksh50 billion kitty to support small and micro enterprises to access affordable credit to initiate and sustain their business.

The President described the initiative as part of implementing the Bottom-Up economic model where everyone can access capital for growth.

“Credit products will be available under the hustler fund to small businesses on digital platforms at affordable rates, being single-digit rates, to individuals through chamas, saccos and cooperatives,” Ruto promised on October 20.

“All borrowers in this platform will not only access affordable credit but also participate in short-term saving plans and long-term pension planning,” he added.