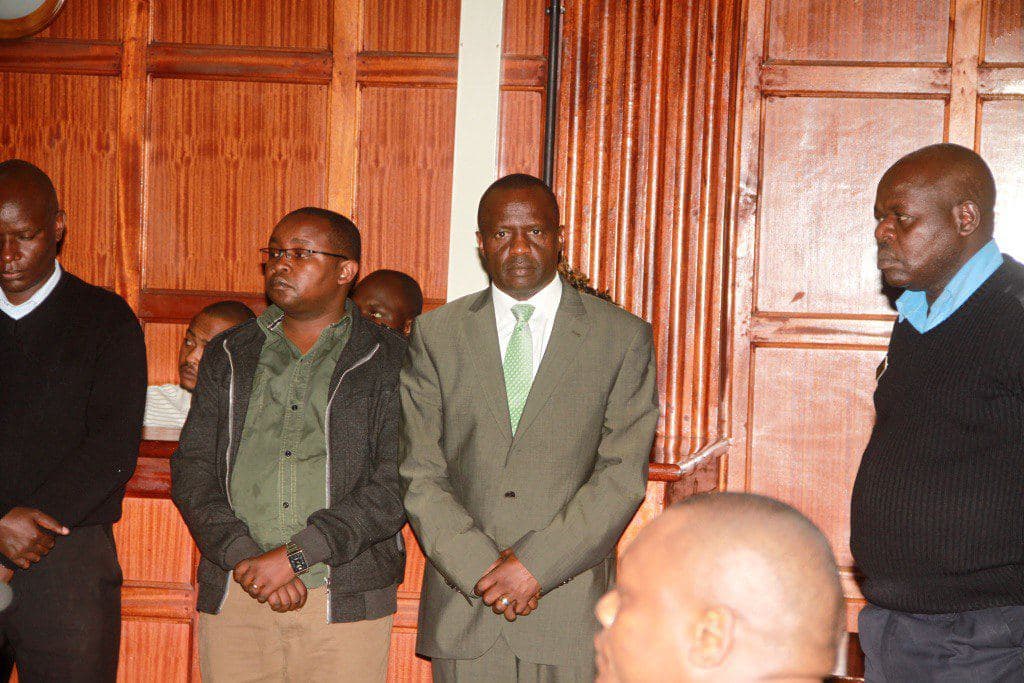

Former CEO of Family Bank Peter Munyiri is now plotting to escape justice through becoming a politician. He is planning to vie for Nyeri Governor seat come 2022.

But though he might have chosen a good time, his history will not leave him alone.

The man who nearly collapsed Family bank though money laundering and handling of proceeds of crime from National Youth Service (NYS); which he is still facing charges for, had a bigger bank that he wanted gone.

He would have succeeded had it not been for a small hiccup at Central Bank of Kenya (CBK) and the Banking Union.

During Martin Oduor-Otieno’s time at the helm of KCB Bank, Munyiri was a restless deputy MD intent on having the head of his boss on a stake.

He dreamt of becoming the head of one of Kenya’s biggest banks so as to engineer looting proportional to the Anglo Leasing heist that had happened just a few years back

Munyiri together with a couple of Kikuyu mafia, who often take Kenya as their bedroom, planned to oust Oduor-Otieno by coercing the powers that be to lower the retirement age for a CEO of KCB.

They succeeded save for the Banking Union which refused these changes and ‘reinstated’ Oduor.

ALSO READ: #FugitiveMunyiri: Kenyans on Twitter call for prosecution of NYS scandal mastermind

Munyiri was not done yet, he had the backing of former powerful GEMA leader, the late Njenga Karume and other crooks from Mount Kenya.

The crooks vouched for a sympathetic CBK governor contender, Jacinta Mwatela who had briefly replaced Andrew Mullei. Mullei had been removed because to corruption.

Jacinta Mwatela acted as CBK’s Governor, from March 2006 to around 2008, and luckily for KCB Bank, Prof Njuguna Ndung’u was appointed in her stead.

When Mwatela got demoted, she threw a lot of tantrums around refusing to take her new posting at the Ministry of Northern Kenya and other Arid Lands as Permanent Secretary. After a brief josttling, she opted to resign and that was the end of the plot to bring down KCB Bank; which would have seen a lot of illegal money passed through the banking giant to its collapse by the crook Munyiri.

Had Mwatela taken over, she would’ve appointed Munyiri KCB CEO.

After the removal of Oduor failed and Munyiri’s plot uncovered, he was transferred to a lesser role where he was later sacked after a restructuring.

Another scandal at KCB

In the same KCB Bank, Munyiri had aided the looting of taxpayers’ money by Yagnesh Devani who in late 2008, caused a nationwide fuel shortage for profits, in what became commonly known as the Sh7.6 billion Triton oil scandal.

Munyiri was rewarded in cash and in kind. His family was flown to Dubai, in an all-expenses-paid trip using Triton dirty cash.

When Mr Oigara came in, he had to clean up some of the mess that Munyiri had created.

Munyiri went on to become CEO of Family Bank, a bank which had risen from a housing Sacco. He repeated his evil mannerism at Family Bank after he was promised by his crooked friends that he’ll be rewarded with CEO seat at National Bank of Kenya (NBK) after Family Bank collapses. Family Bank was fined Sh65 million in the Sh1,6 billion scandal.

ALSO READ: Embattled Former Family Bank MD Peter Munyiri declares war on critics

Devani is coming back and Triton is about to become a big case which will rope in crooks like Peter Munyiri who is now trying to escape by running for Nyeri Gubernatorial seat in 2022.

Not to forget, he still has a case to answer for aiding in the looting of NYS.

His history is with him, his legacy of corruption and aiding crooks to clean dirty money contrary to the Money laundering and Proceeds of Crime Act 2008.